What Policy Do I Need to Pay Off My Mortgage?

One of your most significant investments is your home. In both good and bad times, your home is a constant that you and your family depend on for safety and comfort. For many people with mortgages, payments are not true difficulties, especially considering most payments are less than rent would be for a comparable property. But what happens when one of the primary earners passes away before the house is paid off? Unfortunately, no matter what happens, your mortgage payments will still be due each month, and they must be paid regularly before the sheriff’s note is posted and foreclosure becomes imminent.

One solution to this problem is mortgage protection insurance. This insurance is a seemingly beneficial offer by the mortgage lender that will pay the outstanding balance of your mortgage should you die before it is completely paid off; however, it does have some serious pitfalls that need due consideration. Alternately, at TopLine Life Insurance, our brokers have another solution for the conscientious homeowner who wants to protect his or her family in case the worst should happen: traditional term life insurance.

Read on to learn more about both mortgage protection and term life insurance.

The Competitors

Mortgage Protection Insurance

Mortgage protection insurance, or MPI, is a surprisingly useful tool if you are in poor health and your only concern is paying off your mortgage. Otherwise, there are better plans available. People who have serious health issues usually find it difficult to get approved for most life insurance policies because the medical exams after application will disqualify most of these candidates, leaving them with limited choices. Guaranteed issue, simplified issue, and MPI are usually the only options because they do not require a medical exam for approval. Unfortunately, these plans require higher premiums for lower benefits, and the only one with a benefit big enough to pay off a mortgage is MPI.

Term Life Insurance

Term life insurance is the most popular type of life insurance, especially for younger, healthier customers looking to secure a competitive premium and payout, should they pass away. Term life insurance requires a full underwriting period, including health questions and a medical exam for approval, so better rates are given to applicants who pose less of a risk. This form of insurance requires regular monthly premium payments within a specified term before expiring as well as a renewal. Unlike MPI, term life insurance pays out the death benefit to beneficiaries chosen by the policy owner rather than directly to the mortgage lender.

Which Policy is Right For Me?

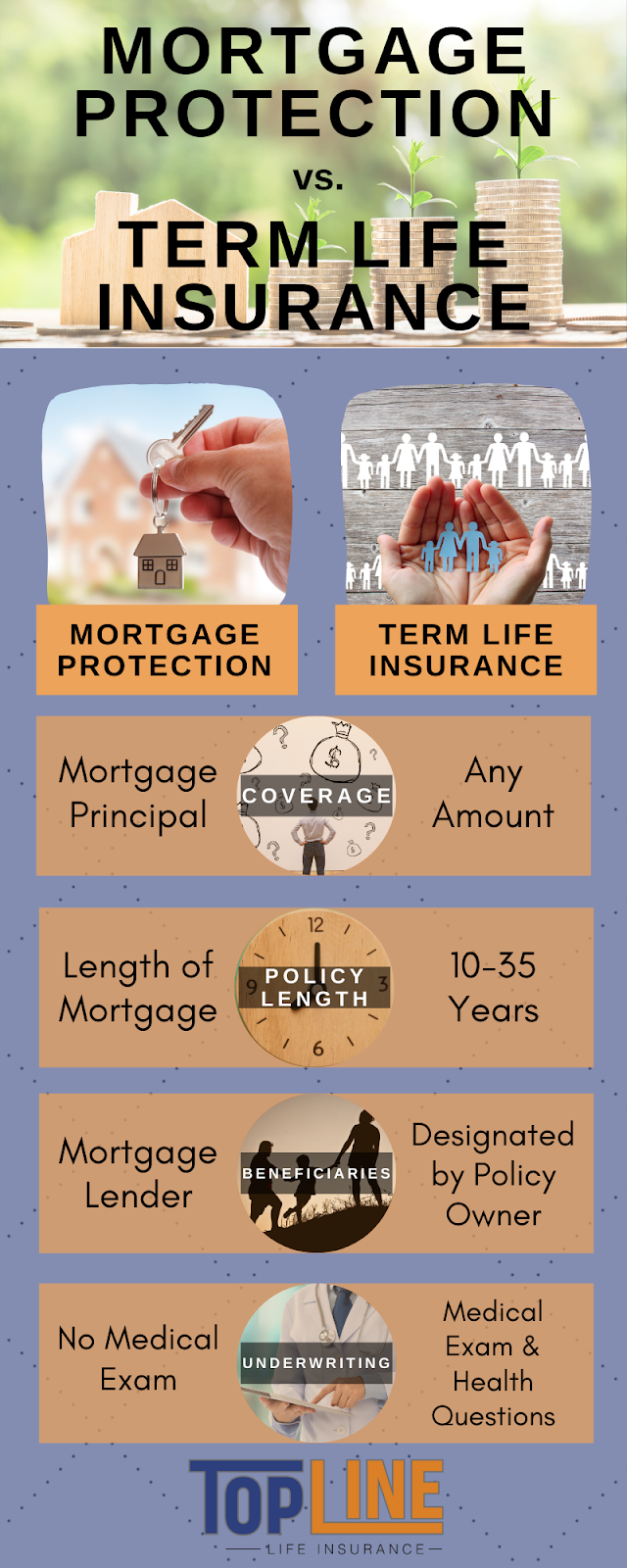

Both policies can be invaluable resources for many families, but they both have some limitations and drawbacks that make it unappealing for others. Take a look at the overview below for a brief comparison of MPI and term life policies:

As you can see, the more versatile and advantageous option is term life insurance. If you choose term life, but are still concerned about your mortgage, we at TopLine can work with you to find the best plan that can cover your mortgage; in fact, we will match the amount of insurance to the amount of your mortgage! With this plan, you can set your own beneficiaries and determine the amount of your death benefit that will go to them and to your mortgage.

Term life insurance is not for everyone, but it can be a huge asset depending on your circumstances and priorities. At TopLine, we offer a huge selection of life insurance policies, so call us today. You can speak to a professional broker about any of our plans to find the right policy for you!

Right Here, Right Now.

Your family’s financial safety net is only a few clicks away. Fill out this quick form and get a life insurance quote from TopLine in seconds.

There are many life insurance policies from which to choose, and the best one for you might not be the best for someone else. If you need lower premiums, a term life insurance policy might be a good option. If you are looking for insurance that provides investment opportunities and does not expire until you pass away, a universal plan is an excellent choice. Speak to a TopLine Life Insurance broker to discuss your options.

A life insurance premium is a regular payment you must make to your insurance company to pay for your life insurance policy. Continuous payments will keep your plan active, while missing payments could cause it to lapse. Different policies have different requirements for premium payments, so research possible policies and contact us at TopLine to find the right plan for you.

This answer differs from person to person and is mostly dependant upon your finances. Typically, your minimum amount should be enough to cover your mortgage, loans, credit cards, and any other outstanding payments and debts.

Other considerations include:

- College tuition assistance for your children or grandchildren

- Income replacement for your spouse

- Estate planning

Speak with a TopLine life insurance broker to avoid over or under-insuring yourself.

Generally speaking, buying a life insurance policy when you are younger and healthier gives you a better chance of locking in a favorable policy premium. By purchasing a plan now, you can guarantee your “insurability” for the future. You won’t have to stress about higher premiums when you get older and possibly experience health issues. Talk to one of our brokers about the best available policies for you.

A beneficiary is a person listed on your life insurance policy which is the full or partial recipient of the death benefit provided by the policy. Anyone can be a beneficiary, and there can be multiple beneficiaries on the same plan. Note: No one is automatically listed as a beneficiary, including your spouse and children, so be sure to indicate your beneficiary choice(s) at the time of your policy purchase.

We are a fully transparent agency, there are no secrets or surprises. We allow consumers to see the companies we represent and allow them to quote prices before they contact us. We want them to know which company offers the lowest prices as opposed to us telling them. Once a program is selected by the consumer or suggested by TopLine, our clients are amazed at the speed in which they are approved for coverage. We have a family mentality that is productive and fun. Our office has almost no turnover, which means you get to know us very well. We are an insurance family, and we treat our clients as an extension of our family, without them, there is no TopLine Insurance.

Compare Quotes

Compare QuotesAt TopLine, we partner with some of the most reputable life insurance companies in the country. We can help you compare quotes and find the best deal.

Get Expert Advice

Get Expert AdviceOur life insurance brokers are experienced and passionate about finding the best policies for our clients. If you are unsure about your options or have any questions, they are happy to help.

Instant Approval

Instant ApprovalDon’t worry about medical exams or your financial situation. With TopLine, you can get approved for a life insurance policy instantly.

See What Our Clients Say

See What Our Clients Say

They said the application process would be fast. I was thinking I would be approved in a few weeks but somehow, they made sure we got approved the same day. Tracy made the approval process simple and walked me through everything.

- Tanya F.